CARES Act Funding Programs

Updated 01.06.2021

Under the Federal CARES Act, the City of Craig was allocated $1,772,564 in CARES Act funds. The funds were intended for response and mitigation measures related to impacts from COVID19 between March 1, 2020 and December 30, 2020. Recently legislation passed by Congress extends use of the CARES Acts funds until September 30, 2021, but this will have minimal effect on Craig’s use of the funds.

Staff worked from Treasury Department guidance on the use of the funds and discussed uses and allocations of funding with the council throughout the process. The amounts on this page are not final until all final invoices, grant agreements and spending reports are closed out.

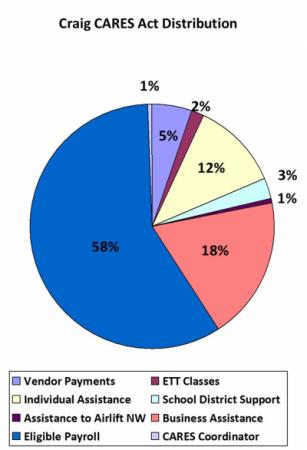

The City of Craig used CARES Acts funds for a number of categories that included:

- Vendor Payments for PPE, building improvements, additional cleaning services, increased contract costs due to COVID19, modifications to how we deliver services (i.e. council meeting broadcasts), and additional expenses for city personnel or contractors due to COVID19. (approximately $94,500)

- ETT Classes. ($26,726)

- Individual Assistance (both assistance through non-profits and direct individual assistance) ($210,000)

- Direct School District Support ($50,000)

- Direct Assistance to Airlift NW ($10,000)

- Economic Assistance to Businesses and Non-Profits ($332,000)

- Eligible Payroll ($1.04 million)

- CARES Act Coordinator ($12,000)

Broadly speaking the city used about 64% of the funding to support city response and mitigation measures (including vendor payments, payroll, and coordinator costs). Approximately 22% of the funds were used for business and non-profit assistance (including the Craig City School District, Airlift NW, and the cumulative business and non-profit grants). About 14% of the available funds were used for individual assistance (including individual assistance through non-profits, direct individual assistance, and the free ETT classes).

The programs developed by staff and approved by the council had the overall effect of providing for the city’s response to the pandemic and providing significant funds for use in the community (about $600,000 in individual and business/non-profit assistance).

The funds used to cover eligible payroll will have the added effect of providing a cushion for sales tax and other revenue shortfalls in the current fiscal year. Third quarter of 2020 sales tax was significantly down and we will know the results of the fourth quarter of 2020 when sales tax reports are submitted at the end of January.

The most recent legislation passed by congress allows for use of the funds until September 30, 2020, but the City of Craig has expended all available CARES Act funds prior to the original deadline of December 30th as planned.